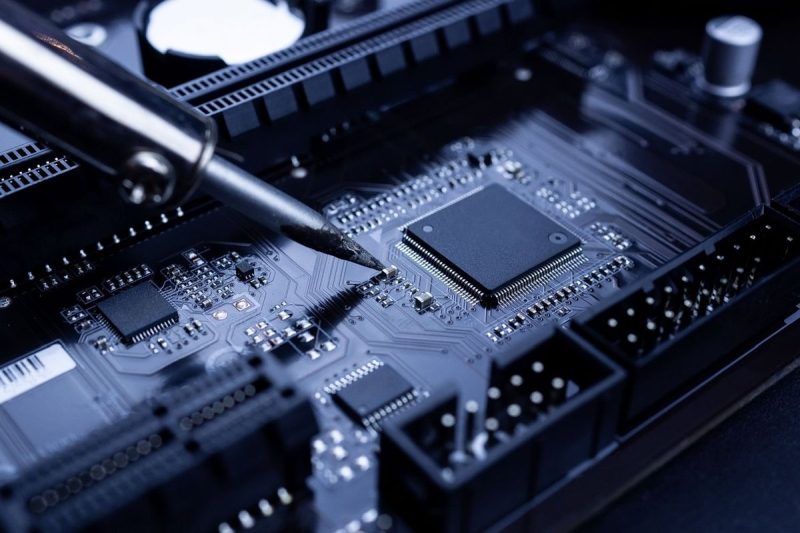

Investing in commodities has always been an attractive option for investors looking to diversify their portfolios and potentially earn significant returns. One such commodity that has seen a recent surge in interest is tin. Used in a wide range of industries, from electronics to packaging, tin is a versatile metal with strong demand drivers that make it an appealing investment opportunity.

Tin stocks are an indirect way to invest in the metal, allowing investors to gain exposure to the commodity without having to manage physical assets. Investing in tin stocks can be a lucrative venture, but it is important to understand the market dynamics and do thorough research before diving in. Here are some key steps to consider when looking to invest in tin stocks in 2024:

1. **Understand the Tin Market**: Before investing in tin stocks, it is crucial to have a good grasp of the tin market. Understanding the factors that influence tin prices, such as supply and demand dynamics, geopolitical events, and industrial trends, can help you make informed investment decisions. Stay updated on market news and developments to anticipate price movements.

2. **Research Tin Companies**: When investing in tin stocks, researching and evaluating tin mining companies is essential. Look for companies with strong track records, a solid balance sheet, and reliable production capabilities. Consider factors such as reserves, production costs, and exploration potential to assess the long-term viability of the company.

3. **Diversify Your Portfolio**: As with any investment, diversification is key to managing risk. Consider investing in a mix of tin stocks to spread your exposure across different companies and projects. Diversification can help mitigate the impact of any negative events that may affect a particular company or sector.

4. **Evaluate Growth Prospects**: Assess the growth prospects of tin companies before investing. Look for companies with expansion plans, new projects in the pipeline, or technological innovations that could drive future growth. Companies that are well-positioned to capitalize on the increasing demand for tin in emerging industries could offer attractive investment opportunities.

5. **Monitor Macro Trends**: Keep an eye on macroeconomic trends that could impact tin prices and the performance of tin stocks. Factors such as economic growth, trade policies, currency fluctuations, and environmental regulations can all influence the tin market. Stay informed about global events that could affect the supply and demand dynamics of the metal.

6. **Risk Management**: Investing in tin stocks carries inherent risks, including price volatility, geopolitical instability, and operational challenges faced by mining companies. Develop a risk management strategy that aligns with your investment goals and risk tolerance. Consider setting stop-loss orders or implementing hedging strategies to protect your investment.

In conclusion, investing in tin stocks can be a rewarding opportunity for investors seeking exposure to the commodity market. By conducting thorough research, diversifying your portfolio, and staying informed about market trends, you can make informed investment decisions that have the potential to generate attractive returns. However, it is important to approach tin stock investing with caution and be prepared to manage risks effectively to navigate the inherent uncertainties of the market.