Investing in Chromium Stocks: A Comprehensive Guide

Understanding Chromium and Its Importance

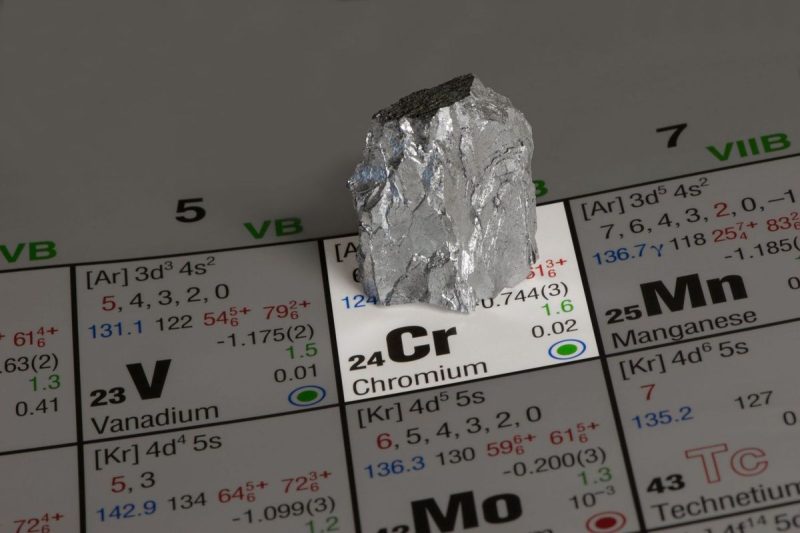

To begin with, it is essential to understand what chromium is and why it holds significance in the industrial and investment sectors. Chromium is a hard, silver-white metal that finds extensive use in various industries due to its corrosion-resistant properties. The metal is primarily used in the production of stainless steel, which is utilized in a wide range of applications, including automotive, aerospace, and construction industries.

Market Analysis and Trends

Before diving into investing in chromium stocks, it is crucial to analyze the current market trends and outlook for the metal. The demand for chromium is expected to remain robust in the coming years, driven by growth in key industries such as stainless steel production, automotive manufacturing, and infrastructure development. With the increasing focus on sustainable practices and the growing adoption of electric vehicles, the demand for stainless steel, and hence chromium, is projected to rise further.

Factors Influencing Chromium Prices

Several factors can influence the prices of chromium in the global market. These include supply and demand dynamics, geopolitical issues, technological advancements in extraction and processing methods, and regulatory policies. Investors keen on investing in chromium stocks must closely monitor these factors to make informed decisions and capitalize on potential opportunities in the market.

Key Players in the Chromium Industry

Investors looking to enter the chromium market can consider exploring opportunities with key players in the industry. Companies involved in chromium mining, processing, and stainless steel production can offer viable investment options. Conducting thorough research on the financial health, growth prospects, and market positioning of these companies can help investors make sound investment choices.

Investment Strategies and Risks

When investing in chromium stocks, it is essential to formulate a well-defined investment strategy based on market research, risk tolerance, and investment goals. Diversification of investments across different companies and sectors related to chromium can help mitigate risks associated with market volatility. Additionally, staying updated on industry developments and global economic trends is crucial for making timely investment decisions.

Future Prospects for Chromium Stocks

Looking ahead, the future prospects for chromium stocks appear promising, given the metal’s indispensable role in key industries and its growing demand in emerging markets. As technological advancements drive innovation in stainless steel production and efficiency in chromium extraction processes, investors can expect lucrative opportunities in the chromium market.

In conclusion, investing in chromium stocks can be a rewarding venture for investors keen on exploring opportunities in the industrial metals sector. By staying informed about market trends, industry dynamics, and key players in the chromium industry, investors can position themselves strategically to benefit from the growth potential of this essential metal.