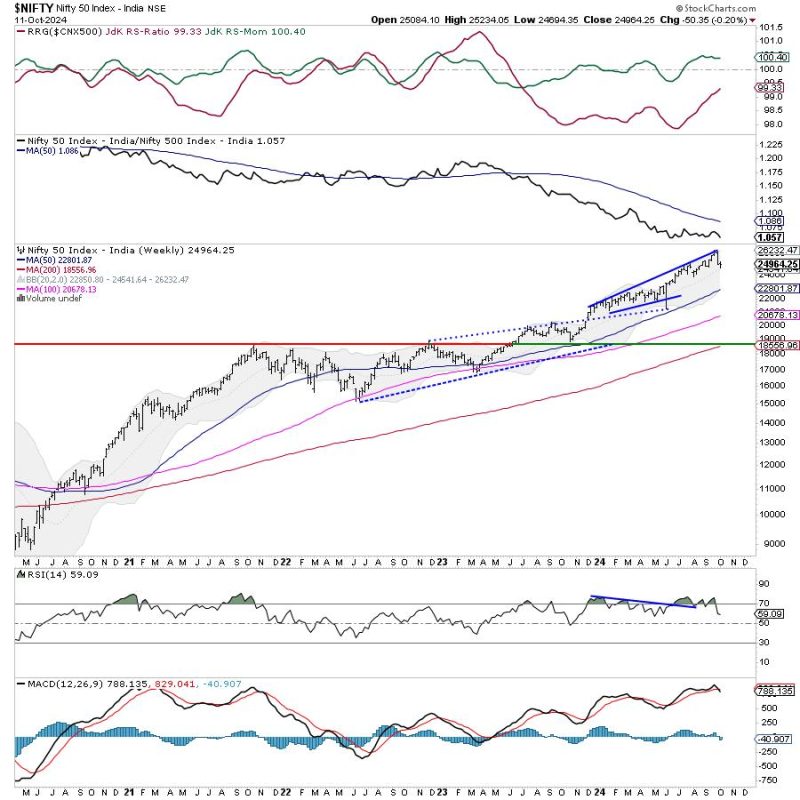

In a recent analysis by expert market watchers, it has been observed that the Nifty index is currently in a consolidation phase. This means that the index is trading within a narrow range after a period of significant movement in either direction.

During a consolidation phase, it is crucial for investors to keep a close eye on key support and resistance levels. These levels act as critical turning points for the index and can help investors make informed decisions about their trades.

One level that investors should pay attention to is the immediate support level, which, if breached, could signal a potential downward move in the index. On the other hand, the resistance level acts as a barrier that the index must break through in order to continue its upward momentum.

Apart from support and resistance levels, another important consideration for investors during a consolidation phase is trendlines. Trendlines are useful tools that help investors identify the overall direction of the market. By connecting the highs and lows of the index over a period of time, investors can gain valuable insights into the underlying trend.

In addition to support, resistance levels, and trendlines, investors should also keep an eye out for technical indicators such as moving averages and relative strength index (RSI). These indicators can provide valuable information about the strength and momentum of the index, helping investors make well-informed trading decisions.

Overall, the current consolidation phase of the Nifty index presents both opportunities and challenges for investors. By closely monitoring key levels, trendlines, and technical indicators, investors can navigate this phase with confidence and make informed decisions about their trades.