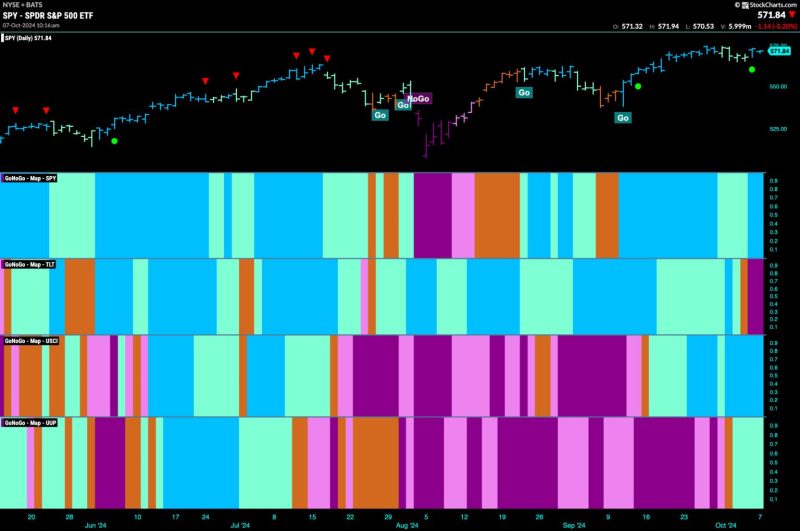

Equities Remain in Go Trend and Lean into Energy

Equities around the world persist in their upward trajectory fueled by positive economic data and strong corporate earnings. Despite initial concerns over inflation and rising interest rates, markets appear to have shrugged off these worries and continue to climb higher. While some volatility is expected along the way, the overall trend remains bullish as investors remain optimistic about the global economic recovery.

One sector that has been particularly buoyant in recent weeks is the energy sector. As economies reopen and demand for oil and gas increases, energy companies are poised to benefit from higher prices and increased consumption. The transition to cleaner energy sources is underway, but in the short term, traditional energy companies are reaping the rewards of a surge in demand.

Investors are increasingly turning their attention to energy stocks as a way to capitalize on the sector’s bullish momentum. Companies involved in oil exploration, refining, and distribution have seen their stock prices soar in recent weeks, with many hitting new all-time highs. With the global economy gaining momentum and supply chain disruptions easing, the outlook for the energy sector remains positive in the near term.

In addition to traditional energy stocks, alternative energy companies are also attracting significant interest from investors. The push towards renewable energy sources is driving growth in solar, wind, and hydroelectric power companies, as governments and corporations alike commit to reducing their carbon footprint. As the world transitions to cleaner energy sources, these companies are likely to play a crucial role in shaping the future of the energy industry.

The recent surge in energy stocks is part of a broader trend of sector rotation as investors rotate capital into areas that are expected to benefit from the post-pandemic economic recovery. While tech stocks were the clear winners during the height of the pandemic, other sectors such as energy, financials, and industrials are now in focus as investors seek to diversify their portfolios and capitalize on new opportunities.

Overall, equities remain in a go trend as investors continue to bet on a strong economic recovery and robust corporate earnings. While there may be bumps along the way, the general sentiment in the market is positive as economies reopen and consumer spending rebounds. The energy sector, in particular, looks set to outperform as demand for traditional and alternative energy sources remains strong.

As always, investors should conduct their own research and consult with financial advisors before making any investment decisions. The current market environment is dynamic and can change rapidly, so it is essential to stay informed and be prepared for any potential shifts in market sentiment.