The past week in the market has proven to be a roller coaster ride for investors and traders alike. However, amidst the volatility, the uptrend for Nifty remained intact, much to the relief of market participants. As we look ahead to the upcoming week, it becomes essential to analyze the market dynamics using various tools and indicators to navigate the uncertainty and make informed decisions.

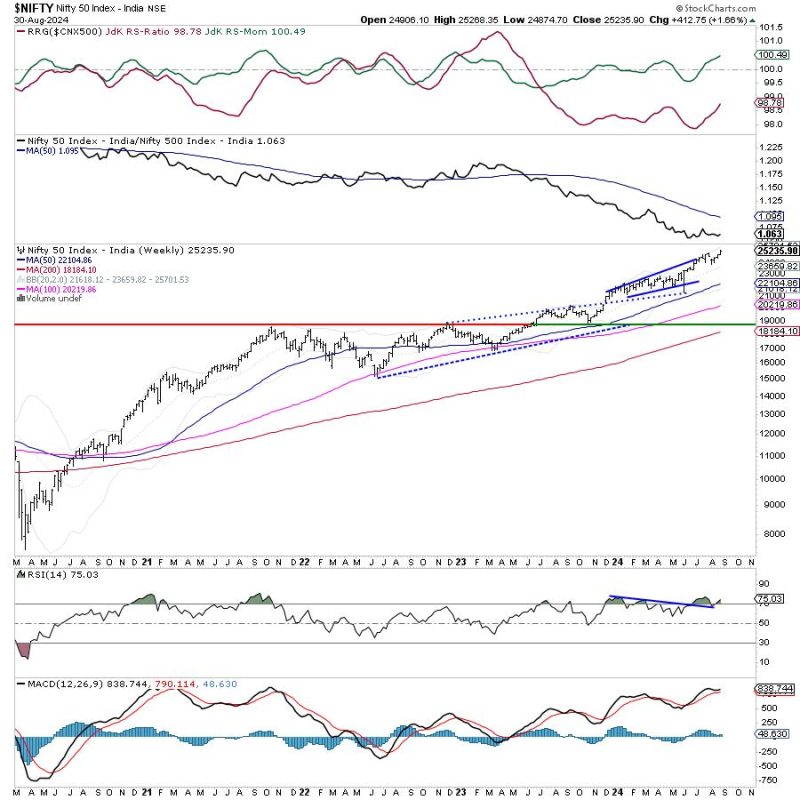

One such tool that provides valuable insights into the relative strength and momentum of various sectors is the Relative Rotation Graph (RRG). In the current scenario, the RRG for Nifty displays a distinctly defensive setup, indicating a shift towards sectors that are considered to be more resilient in times of market turbulence.

For investors, this defensive posture highlighted by the RRG can prove to be a guiding light amidst the volatility. By focusing on sectors that are displaying relative strength and positive momentum, investors can position their portfolios strategically to weather the storm and potentially outperform the broader market.

Additionally, technical analysis also plays a crucial role in understanding the market sentiment and identifying key support and resistance levels. By keeping a close eye on technical indicators such as moving averages, MACD, and RSI, investors can gauge the momentum and strength of the market trends and make informed trading decisions.

Furthermore, geopolitical events and macroeconomic data releases can also impact the market sentiment and direction. With critical events such as central bank meetings, economic data releases, and global developments on the horizon, it is essential for investors to stay informed and adapt their strategies accordingly.

In conclusion, while the market remains uncertain and volatile, the uptrend for Nifty remains intact, providing a ray of hope for investors. By utilizing tools such as the RRG, technical analysis, and staying informed about key economic events, investors can navigate the market turmoil and potentially capitalize on the opportunities presented. As we look ahead to the upcoming week, it is crucial to remain vigilant, adaptable, and focused on risk management to make the most of the prevailing market conditions.