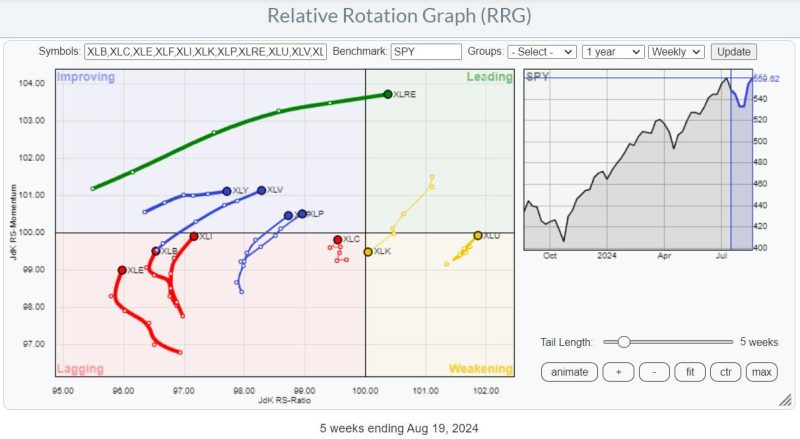

In a recent turn of events, RRG Velocity has caught the attention of many investors as it appears to be jumping on the tail of XLF. This strategic move signals a significant shift in the market dynamics, prompting investors to closely monitor and potentially capitalize on this opportunity.

XLF, a prominent financial sector ETF, has been a steady player in the market, reflecting the performance of key financial institutions. Its movement is often closely watched by investors as an indicator of broader economic trends. The fact that RRG Velocity is now closely aligning itself with XLF suggests that it is seeking to ride on the coattails of the financial sector’s momentum.

This alignment with XLF may signal confidence in the financial sector’s future prospects. Investors often look for signals and patterns in the market to guide their investment decisions, and the move by RRG Velocity to track XLF’s trajectory could be seen as a bullish indicator for the financial sector. It may also suggest that RRG Velocity views the financial sector as a safe haven or a sector with growth potential in the current market conditions.

Analyzing the historical performance and correlation of RRG Velocity with XLF can provide further insights into this strategic move. By examining past trends and patterns, investors can gain a better understanding of the potential implications of this alignment on RRG Velocity’s performance and overall market dynamics.

Moreover, investors need to stay vigilant and continuously monitor the evolving market trends to make informed investment decisions. While aligning with XLF may offer potential benefits, it is essential to consider other factors such as market volatility, economic indicators, and geopolitical events that could impact the financial sector’s performance and, consequently, RRG Velocity’s trajectory.

In conclusion, the recent alignment of RRG Velocity with XLF highlights an interesting development in the market. Investors should closely follow this trend and analyze its potential implications on both RRG Velocity and the financial sector as a whole. By staying informed and monitoring market dynamics, investors can position themselves strategically to capitalize on emerging opportunities and navigate potential risks effectively.