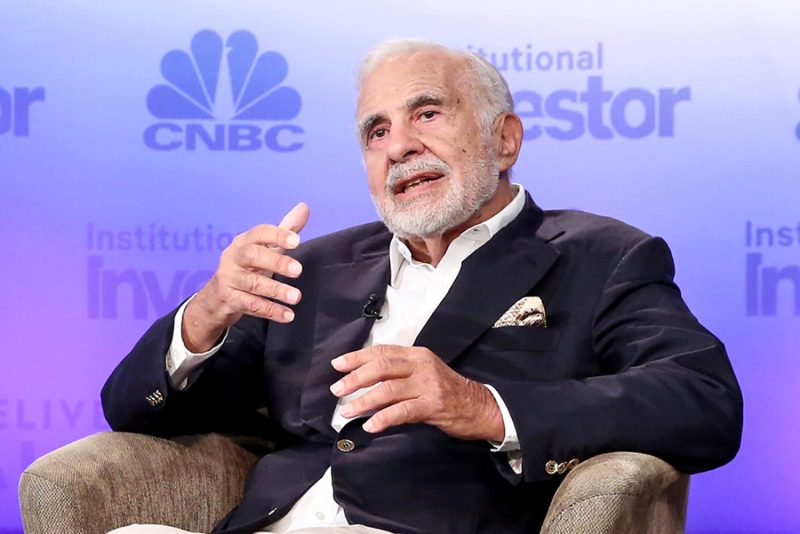

In a recent turn of events, the Securities and Exchange Commission (SEC) has taken a stern stance against billionaire investor Carl Icahn, accusing him of concealing billions of dollars in stock pledges that were made as collateral for personal loans. The allegations have sent shockwaves through the financial world, raising questions about transparency and accountability in high-stakes investing.

Icahn is a renowned figure in the investment community, known for his activist approach to corporate governance and his ability to influence the stock market with his strategic moves. However, the SEC’s charges against him shed light on a darker side of his dealings, suggesting a lack of full disclosure and potential conflicts of interest.

The essence of the SEC’s case lies in the claim that Icahn failed to publicly disclose his significant stock holdings that were used as collateral for loans. By keeping this information hidden, the SEC argues that Icahn deprived investors of crucial insights into his financial arrangements, which could have influenced their decisions regarding his investment activities and the companies in which he holds stakes.

Such allegations not only tarnish Icahn’s reputation as a prominent investor but also raise concerns about the integrity of the financial markets. Transparency is a cornerstone of a fair and efficient market, as investors rely on accurate and timely information to make informed decisions. When influential figures like Icahn are accused of withholding critical details about their holdings, it undermines the trust and credibility of the entire investment ecosystem.

Moreover, the SEC’s charges against Icahn highlight the regulatory gaps and loopholes that can be exploited by powerful individuals in the finance industry. As the case unfolds, it is likely to prompt a reevaluation of existing disclosure requirements and enforcement mechanisms to prevent similar incidents from occurring in the future.

In response to the SEC’s allegations, Icahn has vehemently denied any wrongdoing, stating that he complied with all relevant laws and regulations. Nevertheless, the outcome of this case could have far-reaching implications for both Icahn’s personal reputation and the broader landscape of financial regulation.

In conclusion, the SEC’s charges against Carl Icahn serve as a stark reminder of the importance of transparency and accountability in the investment world. By shedding light on alleged hidden stock pledges worth billions of dollars, the case raises fundamental questions about ethics and integrity in high-stakes investing. As the legal proceedings unfold, the implications of this case are likely to reverberate throughout the financial industry, influencing regulatory practices and investor trust for years to come.