Market Sentiment Indicators: Unveiling the Bearish Phase

1. The Fear and Greed Index

The Fear and Greed Index, developed by CNN Money, is a powerful tool that tracks seven key market indicators to determine whether investors are feeling fearful or greedy. This index ranges from 0 (extreme fear) to 100 (extreme greed), offering a comprehensive view of market sentiment. A reading below 20 suggests extreme fear, signaling a potential buying opportunity, while a reading above 80 indicates extreme greed, hinting at a possible market top. Recently, the Fear and Greed Index has been hovering in the fear territory, indicative of a cautious market sentiment.

2. Put-Call Ratio

Another essential indicator, the Put-Call Ratio, provides insight into options trading activity by comparing the number of put options to call options. A high put-call ratio suggests that investors are more bearish, as they are buying more puts to protect their positions or speculate on a market decline. On the contrary, a low put-call ratio indicates a bullish sentiment, with investors favoring call options for potential gains. In the current market environment, the put-call ratio has been trending higher, signaling increasing concerns among investors and a shift towards a bearish outlook.

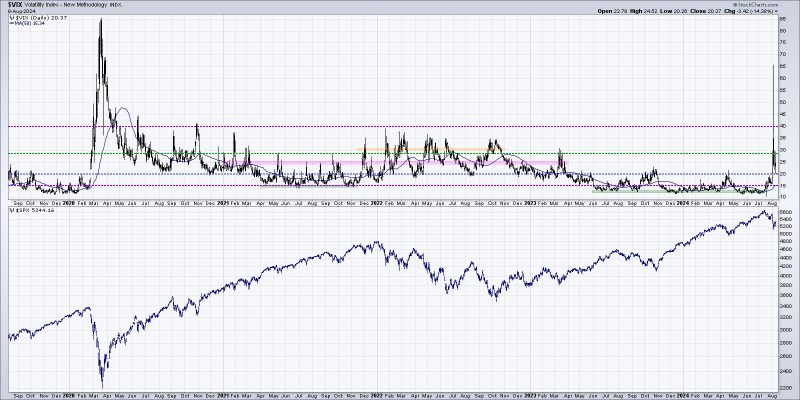

3. VIX Volatility Index

The VIX Volatility Index, often referred to as the fear gauge, measures market volatility and investor expectations for future market fluctuations. When the VIX is low, it indicates that investors are complacent, expecting minimal volatility in the market. Conversely, a high VIX reading suggests heightened fear and uncertainty among investors, anticipating significant price swings. Lately, the VIX has been on the rise, pointing to growing anxiety and a more risk-averse market sentiment. This uptick in volatility underscores the potential for increased market turbulence and downside risk.

In conclusion, the confluence of these three market sentiment indicators – the Fear and Greed Index, Put-Call Ratio, and VIX Volatility Index – provides a compelling case for the current bearish phase in the market. Investors should closely monitor these indicators to gauge shifting sentiment and adjust their investment strategies accordingly. By staying informed and responsive to market dynamics, investors can navigate the uncertain terrain with greater insight and confidence.