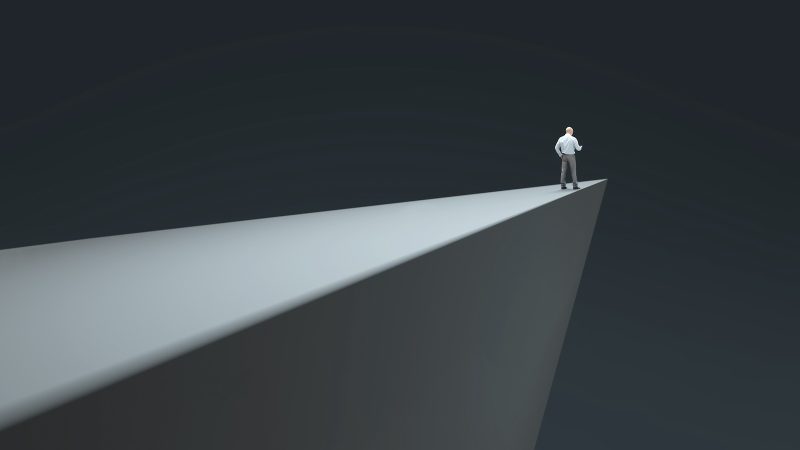

The article Critical Levels to Watch as Nasdaq Teeters on the Edge published on GodzillaNewz highlights the precarious situation facing the Nasdaq as it flirts with critical levels. The tech-heavy index has been under pressure recently as investors navigate uncertain market conditions. Several key levels are being closely monitored by market participants as they seek to gauge the direction of the Nasdaq in the near term.

One of the crucial levels to watch is the support level at 12,500. This level has served as a crucial turning point in the past, providing a floor for the index during periods of turbulence. If the Nasdaq manages to hold above this level, it could signal a potential rebound in the coming days. However, a breach below this support level could open the door to further downside, potentially signaling a more prolonged downturn for the index.

Another important level to keep an eye on is the resistance level at 13,000. This level has acted as a barrier to further upside for the Nasdaq in recent trading sessions. A decisive break above this level could pave the way for a bullish trend to resume, potentially sending the index to new highs. On the other hand, a failure to breach this resistance level could indicate that the Nasdaq is struggling to gain momentum, leading to further consolidation or even a deeper pullback.

Additionally, the article points out the significance of monitoring technical indicators such as the Relative Strength Index (RSI) and Moving Averages. These tools can provide valuable insights into the underlying strength or weakness of the index and help investors make more informed trading decisions. A diverging RSI or a crossover of moving averages could signal a shift in momentum and potentially guide the direction of the Nasdaq in the short to medium term.

Overall, the Nasdaq finds itself at a critical juncture, with several key levels and technical indicators pointing to a potential inflection point in the market. Investors are advised to closely monitor these critical levels and technical signals to navigate the current market environment effectively. By staying informed and responsive to market developments, traders can position themselves to capitalize on potential opportunities or mitigate risks in the ever-changing landscape of the stock market.