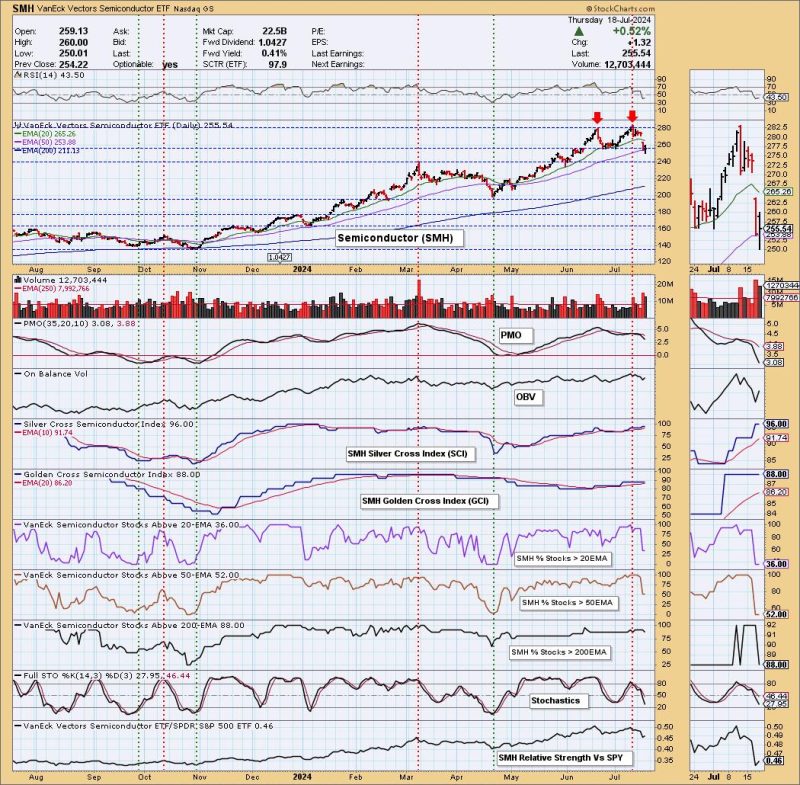

In the world of finance and technical analysis, patterns often emerge that signal potential movements in the markets. One such pattern that has caught the attention of traders and analysts is the double top formation on semiconductors, specifically the SMH (VanEck Vectors Semiconductor ETF). This pattern is a bearish reversal pattern that could indicate a potential downturn in the semiconductor sector. Let’s delve deeper into the intricacies of the double top pattern and what it could mean for investors in the semiconductor industry.

The double top pattern is characterized by two peaks at approximately the same price level, with a trough in between. The first peak represents a high point in the price, followed by a temporary decline (trough), and then another peak that fails to surpass the high of the first peak. This failure to exceed the initial high is a signal to traders that the upward momentum is weakening, and a reversal may be on the horizon.

In the case of the SMH, the double top formation could suggest that the semiconductor sector is reaching a point of exhaustion and that a potential bearish trend may be looming. Traders who recognize this pattern may choose to take a cautious approach, considering reducing their exposure to semiconductor stocks or even taking short positions to profit from a possible decline.

It is important to note that technical analysis, including pattern recognition, is just one tool in a trader’s arsenal and should be used in conjunction with other forms of analysis. Market conditions, economic factors, and company-specific news can all impact the direction of stock prices and should be taken into consideration when making investment decisions.

While the double top pattern on the SMH may raise concerns among investors in the semiconductor sector, it is essential to remember that patterns are not foolproof indicators of future price movements. Markets are complex and unpredictable, and there are no guarantees when it comes to investing. Traders should conduct thorough research, stay informed about market developments, and use risk management strategies to navigate potential risks.

In conclusion, the double top pattern on semiconductors, specifically the SMH, is worth paying attention to for traders and investors in the semiconductor sector. Recognizing patterns and understanding their implications can help market participants make more informed decisions and manage risks effectively in the ever-changing world of finance and investing.