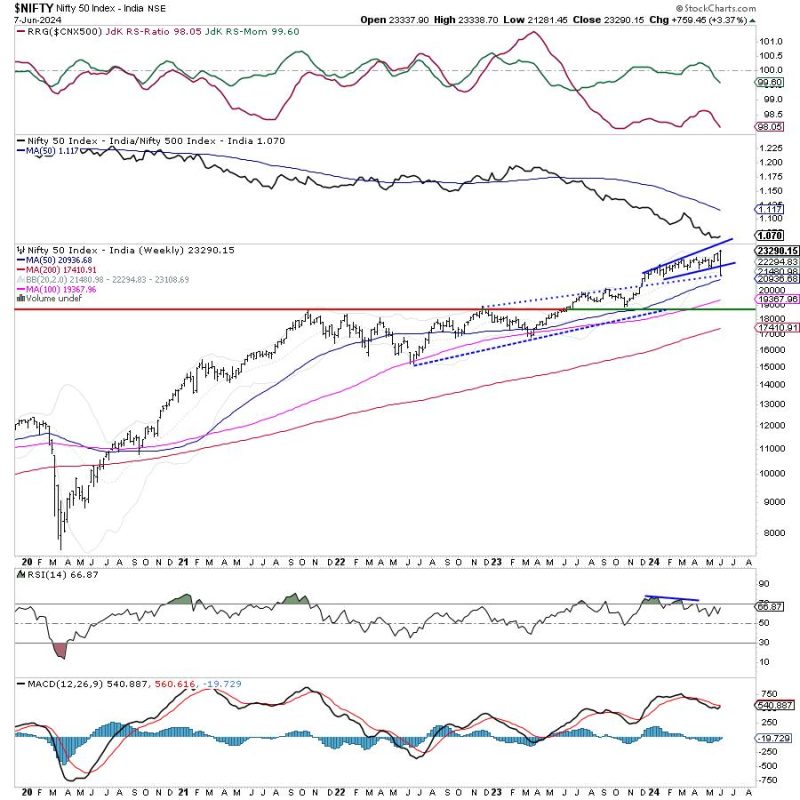

In the world of trading and investing, keeping an eye on market breadth is a crucial aspect that can provide valuable insights into the overall health of the market. As the market pulls back, concerns over market breadth inevitably come to the forefront, with investors closely watching for signs of a potential retracement. The Indian stock market, represented by the Nifty index, has been particularly susceptible to retracement recently, adding to the importance of monitoring market breadth to anticipate potential movements.

Market breadth refers to the number of individual stocks that are participating in a market move. A healthy market typically sees a broad participation across various sectors and stocks, indicating strength in the overall market trend. On the other hand, a market with poor breadth may indicate that only a few stocks are driving the market higher, which could be a sign of weakness and limited sustainability in the trend.

Despite the recent pullback in the market, concerns over market breadth persist. The broader participation across stocks that is often seen in a healthy market has been lacking, raising concerns among investors about the sustainability of the current market trend. As the Nifty remains prone to retracement, analyzing market breadth becomes even more critical in order to gauge the underlying strength of the market.

One way to track market breadth is through the Advance-Decline Line (ADL), which measures the number of advancing stocks versus declining stocks in a given market. A strong ADL suggests broad participation and strength in the market, while a weak ADL could signal underlying weakness and potential retracement. Monitoring the ADL can provide valuable insights into the overall health of the market and help investors anticipate potential market movements.

In addition to the ADL, other breadth indicators such as the McClellan Oscillator and the percentage of stocks above their moving averages can also be valuable tools in assessing market breadth. These indicators can offer a more comprehensive view of market participation and help investors make more informed decisions in response to shifting market dynamics.

As the Nifty index remains prone to retracement, staying vigilant about market breadth is essential for investors looking to navigate the current market environment successfully. By carefully monitoring breadth indicators and analyzing the participation of individual stocks in the market move, investors can gain a better understanding of the underlying trends and potential risks in the market.

In conclusion, while concerns over market breadth persist amidst the recent pullback, staying informed and proactive in monitoring breadth indicators can provide valuable insights into the overall health of the market. As the Nifty remains vulnerable to retracement, analyzing market breadth becomes a crucial aspect of making well-informed investment decisions and navigating the evolving market landscape. By utilizing tools such as the Advance-Decline Line and other breadth indicators, investors can better position themselves to anticipate market movements and manage their portfolios effectively in the face of uncertainty.