Relative Strength and Other Measures in Rules-Based Money Management

When it comes to rules-based money management strategies, incorporating relative strength and other key measures can play a significant role in achieving success in the financial markets. While there are various factors to consider when designing a robust investment approach, understanding how relative strength and other metrics can influence decision-making is essential.

Relative strength is a powerful indicator used to assess the performance of a security relative to a benchmark or another security. By comparing the price movement of an asset to its peers or a relevant index, investors can identify assets that are outperforming or underperforming the market. This information can be crucial in selecting investments that have the potential to generate superior returns.

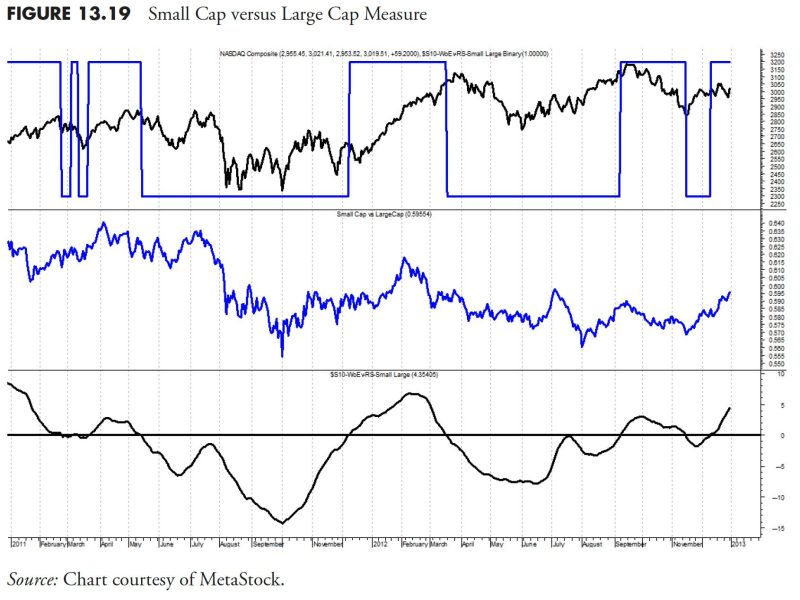

One common method of measuring relative strength is through ratio analysis. This involves dividing the price of one security by the price of another to calculate a ratio. By tracking these ratios over time, investors can identify trends and patterns that may indicate potential opportunities for outperformance or underperformance.

Another important measure in rules-based money management is correlation analysis. Correlation measures the relationship between two variables, such as the prices of two assets. By understanding the correlation between different investments, investors can build a diversified portfolio that minimizes risk and enhances returns. A portfolio consisting of assets that are negatively correlated, for example, can help reduce overall volatility and provide a more stable investment profile.

Volatility is another key metric that should be considered in rules-based money management. Volatility measures the degree of price fluctuations in an asset. Assets with higher volatility tend to have greater price swings, which can present both opportunities and risks for investors. By incorporating volatility analysis into investment decisions, investors can adjust their risk tolerance and position sizes accordingly to optimize returns while managing risk.

In addition to relative strength, correlation, and volatility, other measures such as momentum, trend analysis, and fundamental indicators can also play a crucial role in rules-based money management. Momentum, for instance, analyzes the rate of change in asset prices and helps investors identify assets that are gaining or losing momentum. Trend analysis, on the other hand, examines the direction of price movements over a specific period, providing insights into potential market trends.

Fundamental indicators, such as earnings growth, valuation metrics, and macroeconomic factors, can also be integrated into rules-based money management strategies to assess the underlying value and prospects of an investment. By combining these various measures, investors can develop a comprehensive framework for decision-making that factors in both technical and fundamental considerations.

In conclusion, relative strength and other key measures are essential components of rules-based money management strategies. By leveraging these metrics effectively, investors can enhance their ability to select investments that have the potential to outperform the market while managing risk. Ultimately, a robust rules-based approach that integrates various measures can lead to more informed and disciplined investment decisions, paving the way for long-term success in the financial markets.