Certainly! Here is a well-structured and unique article:

### The Shift in Stock Market Trends: Value Taking the Lead

## The Rise and Fall of Growth Stocks

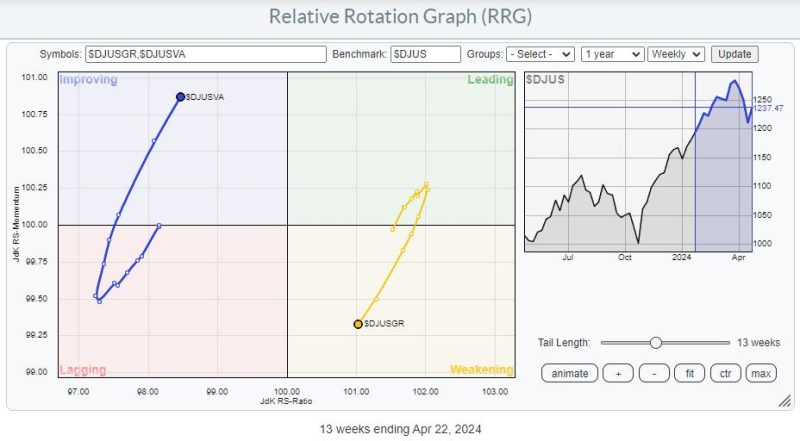

The last decade has witnessed an unprecedented rise in growth stocks, with tech companies dominating the market and achieving significant valuation. However, recent shifts in the market have highlighted a change in investor sentiment, with value stocks now taking the lead. This shift has important implications for investors as they navigate the complex landscape of the stock market.

Growth stocks have been the darlings of Wall Street for some time, driven by rapid technological advancements and high-growth potential. Companies like Amazon, Tesla, and Netflix have seen meteoric rises in their stock prices, attracting investors seeking quick returns. However, the allure of growth stocks has also led to concerns about overvaluation and potential market correction.

## The Downside Risks of Growth Stocks

While growth stocks offer the promise of high returns, they also come with significant downside risks. One of the key risks associated with growth stocks is their vulnerability to market fluctuations and changing investor sentiment. As seen in recent months, a shift in market dynamics can lead to sharp declines in the value of growth stocks, eroding investor wealth.

Moreover, growth stocks often trade at high price-to-earnings ratios, making them susceptible to market corrections. If market conditions sour or investor sentiment turns negative, growth stocks can be hit hard, leading to significant losses for investors. This heightened volatility is a major downside risk for those heavily invested in growth stocks, especially during uncertain economic times.

## The Rise of Value Stocks

In contrast to growth stocks, value stocks are often overlooked by investors seeking quick gains. However, recent market trends have shown a resurgence in interest in value stocks, as investors look for stable and undervalued companies with solid fundamentals. Value stocks typically trade at lower valuations compared to growth stocks, making them less susceptible to market volatility.

As the market shifts towards a more value-oriented approach, investors are reconsidering their investment strategies to include a mix of value stocks in their portfolios. This shift is driven by the belief that value stocks offer a more stable and sustainable long-term investment option, providing a hedge against market downturns and economic uncertainties.

## Investing Strategies in a Changing Market

For investors navigating the changing landscape of the stock market, it is crucial to reassess their investment strategies and diversify their portfolios accordingly. While growth stocks may offer higher returns in the short term, they also come with increased risks and volatility. On the other hand, value stocks provide a more stable and conservative investment option, offering protection against market fluctuations.

By diversifying their portfolios with a mix of growth and value stocks, investors can mitigate risk and achieve a more balanced investment approach. This balanced strategy allows investors to capitalize on the growth potential of high-flying tech stocks while also safeguarding their wealth against market downturns.

In conclusion, the recent shift in market dynamics towards value stocks underscores the importance of a diversified investment strategy. By carefully balancing growth and value stocks in their portfolios, investors can navigate the ups and downs of the stock market with confidence and resilience.