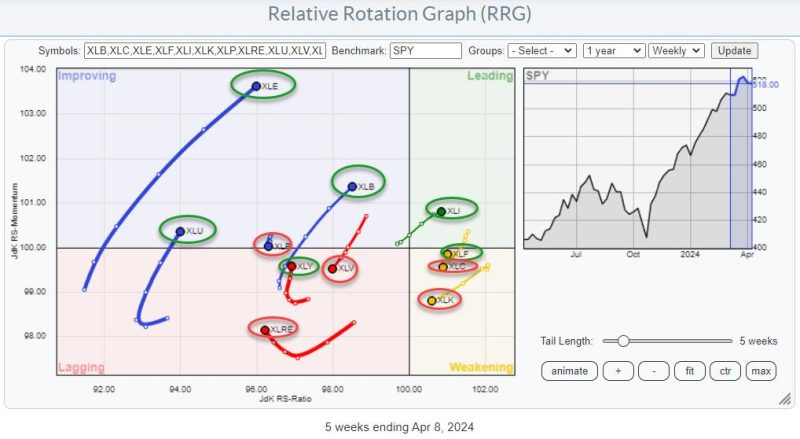

Rudy’s Research Group (RRG) Indicates Non-Mega Cap Technology Stocks are Improving

In a recent report, Rudy’s Research Group (RRG) has identified a positive trend in the performance of non-mega cap technology stocks. This analysis sheds light on the growing opportunities within this sector and the potential for investors to capitalize on this improvement.

One key highlight from the RRG analysis is the increasing momentum observed in non-mega cap technology stocks. As larger companies such as Apple, Amazon, and Microsoft have historically dominated the tech sector, smaller and mid-size tech firms have often been overlooked. However, the data presented by RRG suggests that these non-mega cap stocks are now gaining traction and generating positive returns.

Furthermore, the report indicates that the performance of non-mega cap technology stocks is now more closely aligned with market trends, indicating a higher level of integration and competitiveness within the sector. This shift signifies a maturation of the industry, where smaller companies are no longer relegated to the periphery but are actively contributing to the overall growth and innovation in technology.

Additionally, RRG’s analysis underscores the resilience of non-mega cap technology stocks during times of volatility. While mega-cap companies may experience more pronounced fluctuations in their stock prices, smaller tech firms have shown a capacity to weather market turbulence and continue to deliver value to investors.

Moreover, the report highlights the diversification benefits that non-mega cap technology stocks can offer to investors’ portfolios. By including these smaller tech companies in their investment strategies, investors can access a broader range of opportunities and potentially enhance the overall performance and risk profile of their portfolios.

Overall, RRG’s research provides valuable insights into the evolving landscape of non-mega cap technology stocks. As these companies continue to demonstrate their potential for growth and profitability, investors may find new avenues for generating returns and diversifying their investment portfolios. By keeping a close eye on this sector and leveraging the opportunities it presents, investors can position themselves to benefit from the ongoing advancements in technology and innovation.