Market Sentiment Shifting as Investors Brace for Potential Downturn

As signs of a potential market correction continue to emerge, investors are closely monitoring the changing landscape to make informed decisions. The recent uptrend in the market has shown signs of exhaustion, leading to growing concerns among market participants. Sentiment indicators are pointing towards a shift in investor behavior, with many bracing for a potential downturn.

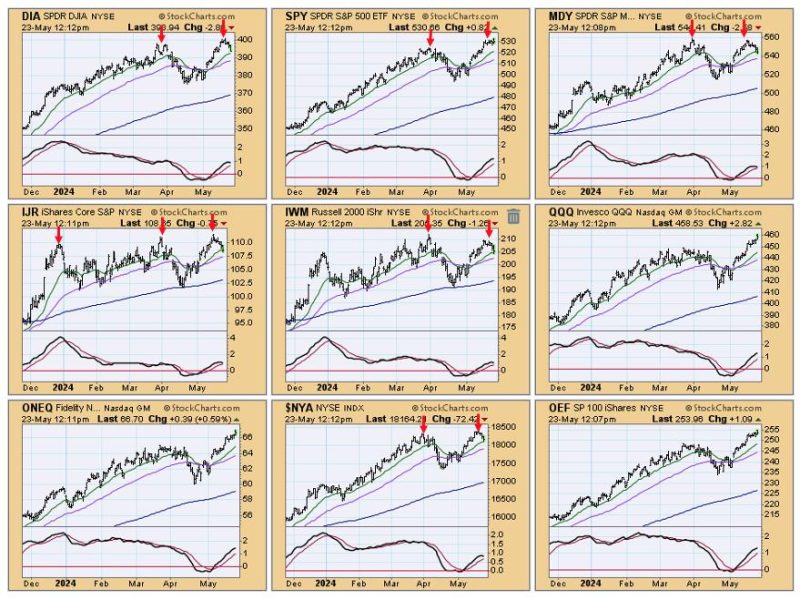

One key indicator that is causing alarm among investors is the increasing level of market volatility. Volatility measures the degree of variation of trading prices over a certain period, and heightened volatility often precedes market downturns. In recent weeks, we have witnessed sharp fluctuations in stock prices, indicating a nervousness in the market that could potentially lead to a broader sell-off.

Moreover, market breadth, which measures the number of stocks advancing versus declining, has shown signs of weakness. A narrowing market breadth, where only a few stocks are driving the market higher while the majority are lagging behind, is often viewed as a warning sign of an impending market correction. Investors are closely monitoring this metric to gauge the overall health of the market.

Another factor contributing to the shift in market sentiment is the uncertainty surrounding global economic conditions. Growing geopolitical tensions, inflationary pressures, and potential policy changes are casting a shadow of uncertainty over the market. Investors are keenly watching economic indicators and central bank decisions for clues on how these factors may impact market performance in the coming months.

Additionally, valuations in certain sectors have reached elevated levels, raising concerns about a potential bubble in the market. Stocks in high-growth sectors, such as technology and clean energy, have seen astronomical price increases, leading to questions about their sustainability. Investors are increasingly cautious about chasing overvalued stocks and are diversifying their portfolios to mitigate risk.

In response to these warning signs, investors are adjusting their strategies to prepare for a potential downturn. Some are taking profits and rebalancing their portfolios to reduce exposure to high-risk assets. Others are hedging their positions using options or other derivative instruments to protect against downside risk. Overall, the shift in market sentiment is prompting investors to adopt a more cautious approach to navigate the uncertain market environment.

In conclusion, as signs of a potential market correction continue to mount, investors are closely monitoring key indicators and adjusting their strategies accordingly. The shift in market sentiment reflects growing concerns about overvaluation, volatility, and global economic uncertainty. By staying informed and proactive, investors can better position themselves to weather potential market turbulence and capitalize on opportunities that may arise in the midst of uncertainty.