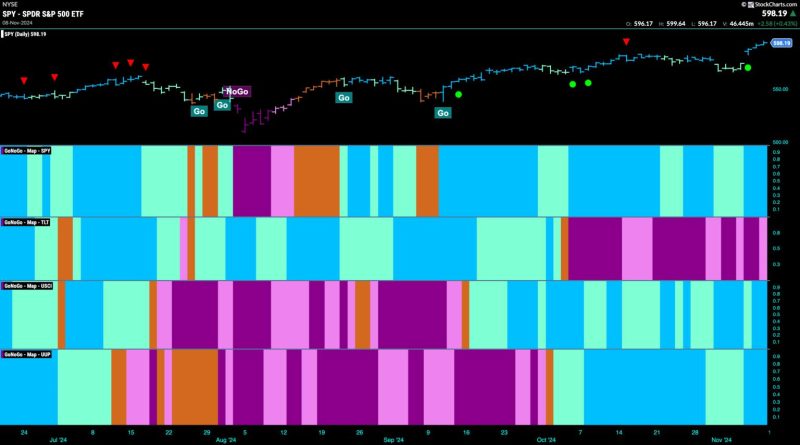

The article provided discusses the growing trend of equity go, which has seen a surge in strength driven by financials pushing the price of these assets higher. Equity go refers to an investment strategy where investors buy assets with the expectation of future price appreciation. The key driver behind this trend is the performance of the financial sector.

Financial stocks have been leading the market higher in recent times, buoyed by strong earnings reports and positive economic data. The sector’s outperformance has caught the attention of many investors who see financial stocks as a reliable bet in the current market environment.

One of the reasons behind the financial sector’s strength is the overall health of the economy. With economic indicators pointing towards robust growth, investors are optimistic about the future prospects of financial companies. This positive sentiment is reflected in the rising prices of financial stocks, which have been outperforming other sectors in the market.

Another factor driving the surge in equity go is the low interest rate environment. With interest rates at historic lows, investors are finding it challenging to generate meaningful returns from traditional fixed-income investments. As a result, many are turning to equities as a source of potential capital appreciation.

Additionally, the Federal Reserve’s accommodative monetary policy has also played a role in boosting equity prices. The Fed’s commitment to keep interest rates low and provide liquidity to the market has created a favorable environment for equities to thrive.

Moreover, the rise of online trading platforms and the democratization of investing have enabled more retail investors to participate in the stock market. This increased participation has added fuel to the surge in equity go, as more individuals are looking to capitalize on the market’s momentum.

Despite the bullish sentiment surrounding equity go, investors should exercise caution and conduct thorough research before jumping into the trend. Market dynamics can change quickly, and it’s essential to have a well-thought-out investment strategy to navigate potential risks.

In conclusion, the surge in strength of equity go, particularly driven by the financial sector, underscores the importance of staying informed and adaptable in the ever-changing landscape of investing. By monitoring market trends, economic indicators, and individual stock performance, investors can make informed decisions and capitalize on opportunities in the market.