In the fast-paced world of finance, market movements can often be filled with uncertainty and volatility. With the constant stream of news and events impacting global economies, investors are always on the lookout for signals that may indicate short-term trends. One such signal that has emerged recently is causing some to view the markets with a bearish outlook.

At the forefront of this signal is the anticipation of a news-heavy week that is expected to bring about significant market shifts. Investors are bracing themselves for a flurry of announcements that have the potential to impact various sectors and individual stocks. From earnings reports to economic data releases, the upcoming week is shaping up to be a crucial time for market watchers.

The anticipation of these news events is leading some investors to take a cautious approach, as uncertainty looms over how the market will react. The fear of unexpected developments causing sudden shifts in prices is prompting many to adopt a more defensive stance in their investment strategies.

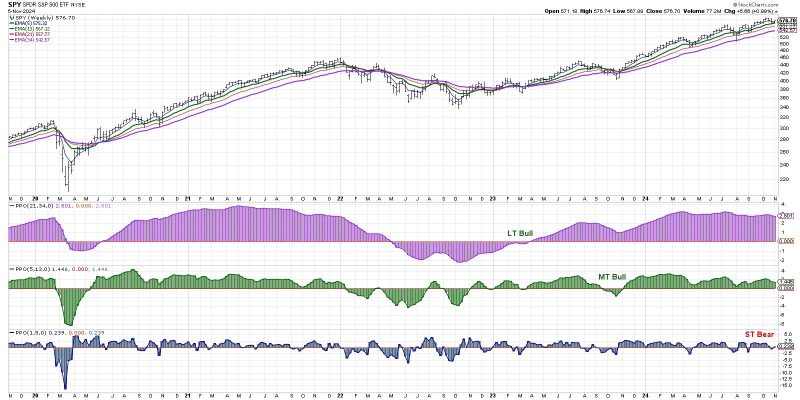

Additionally, technical indicators are also pointing towards a potential short-term downtrend in the markets. With key moving averages showing signs of weakening and certain patterns indicating a bearish outlook, some traders are preparing for a possible pullback in stock prices.

While these signals may suggest a short-term bearish trend, it is important for investors to exercise caution and not make impulsive decisions based solely on market predictions. The volatility in the markets can often lead to unexpected outcomes, and it is crucial for investors to have a well-thought-out strategy in place to navigate these uncertain times.

Ultimately, while the current signals may indicate a bearish sentiment in the short-term, it is essential for investors to maintain a long-term perspective and focus on their overall investment goals. By staying informed, exercising prudence, and remaining adaptable in the face of market fluctuations, investors can better position themselves to weather the storm and capitalize on opportunities that arise in the ever-changing world of finance.