In recent years, artificial intelligence (AI) has been making waves in various industries, and the field of AI technology has been expanding rapidly. One groundbreaking technology that has garnered significant attention is AlphaFold, developed by DeepMind, a subsidiary of Alphabet Inc. Investors are increasingly interested in the potential of AlphaFold and seeking ways to invest in this cutting-edge AI technology. This article will explore the different aspects of investing in AlphaFold stock, providing insight and guidance for those looking to capitalize on this innovative technology.

**Understanding AlphaFold and Its Significance**

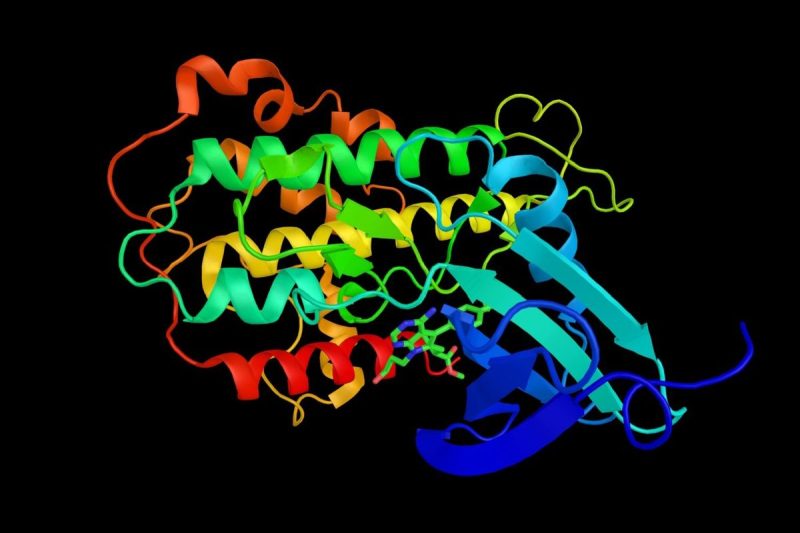

AlphaFold is an AI system developed for protein folding prediction, a fundamental problem in bioinformatics with vast implications for drug discovery, disease research, and personalized medicine. DeepMind made headlines in 2020 when AlphaFold outperformed competitors in the Critical Assessment of Structure Prediction (CASP) competition, an event that demonstrated the technology’s ability to predict protein structures with high accuracy.

The success of AlphaFold has the potential to revolutionize the field of structural biology, enabling scientists to understand the structure and function of proteins in ways previously thought impossible. Investors are drawn to AlphaFold not only for its technological prowess but also for its disruptive potential in various industries, including healthcare, pharmaceuticals, and biotechnology.

**Ways to Invest in AlphaFold Stock**

1. **Alphabet Inc. (GOOGL)**: As the parent company of DeepMind, Alphabet Inc. offers indirect exposure to AlphaFold through its ownership of the AI subsidiary. Investing in Alphabet Inc. provides investors with a diversified portfolio that includes exposure to various innovative technologies beyond just AlphaFold.

2. **ETFs and Mutual Funds**: Investors can also explore ETFs and mutual funds that focus on AI, technology, or healthcare sectors. By investing in ETFs that hold stocks of companies involved in AI research and development, investors can gain exposure to AlphaFold indirectly.

3. **Direct Investment in DeepMind**: While DeepMind is not publicly traded, there may be opportunities for accredited investors to participate in funding rounds or private placements. However, investing in private companies like DeepMind requires thorough due diligence and a high tolerance for risk.

**Considerations Before Investing in AlphaFold Stock**

1. **Risk and Volatility**: Investing in cutting-edge technologies like AlphaFold comes with inherent risks and volatility. Investors should be prepared for price fluctuations and the uncertainty surrounding the market adoption of AI technologies.

2. **Long-Term Potential**: While the immediate impact of AlphaFold is evident in the scientific community, the long-term commercial viability and revenue potential of the technology are still unfolding. Investors should consider the long-term prospects of AlphaFold before making investment decisions.

3. **Diversification**: As with any investment, diversification is key to managing risk. While AlphaFold shows promise, it should be just one component of a well-rounded investment portfolio that includes a mix of assets to spread risk.

In conclusion, investing in AlphaFold stock offers an opportunity to be part of the unfolding revolution in AI technology and biomedicine. However, potential investors should conduct thorough research, consider the risks and long-term potential, and ensure diversification in their investment portfolios. By staying informed and making prudent investment decisions, investors can position themselves to capitalize on the transformative potential of AlphaFold and AI technology in the years to come.