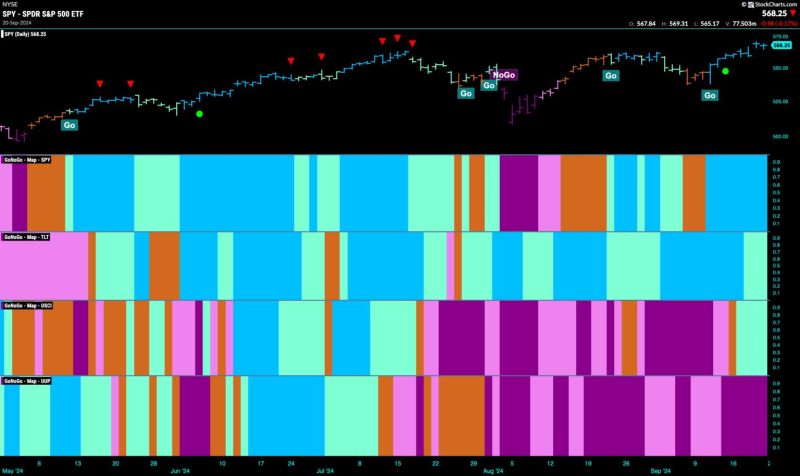

Equities Remain in Strong Go Trend Powered by Financials

According to the latest market analysis and forecasts, the equity markets are maintaining a robust go trend, largely driven by the performance of financial sector stocks. This strong momentum in the equities market comes as a result of several key factors that are influencing investor sentiments and market dynamics.

One of the primary reasons behind the current strength in equities is the resilient performance of financials. Financial sector stocks have been outperforming the broader market, supported by factors such as rising interest rates, improving economic data, and strong corporate earnings. The financial sector is seen as a bellwether for the overall health of the economy, and its strong performance is often viewed as a positive sign for the broader market.

In addition to financials, other sectors such as technology, healthcare, and consumer discretionary have also been contributing to the positive momentum in equities. These sectors have been benefiting from various trends and catalysts, including technological innovation, demographic shifts, and changing consumer preferences. As a result, stocks within these sectors have been attracting strong investor interest and driving the overall market higher.

Another factor that is supporting the go trend in equities is the accommodative monetary policy stance of central banks around the world. The Federal Reserve, European Central Bank, and other major central banks have maintained dovish policies, keeping interest rates low and providing ample liquidity to the financial markets. This supportive policy environment has helped to offset concerns about inflation and geopolitical risks, providing a favorable backdrop for equities to thrive.

Furthermore, the ongoing vaccination efforts and gradual reopening of economies following the COVID-19 pandemic have also been bolstering investor confidence and economic recovery prospects. As businesses resume operations and consumer spending rebounds, corporate earnings are expected to improve, further fueling the rally in equities.

Despite the positive outlook for equities, investors should remain cautious and vigilant in the face of potential risks and uncertainties. Geopolitical tensions, inflationary pressures, and unexpected developments in the global economy could all pose challenges to the current go trend in equities. It is essential for investors to stay informed, diversify their portfolios, and actively monitor market developments to navigate these risks effectively.

In conclusion, the equities market remains in a strong go trend, propelled by the robust performance of financials and other key sectors. With supportive market dynamics, accommodative central bank policies, and improving economic conditions, equities are poised to continue their upward trajectory. However, investors should remain mindful of potential risks and stay proactive in managing their portfolios to capitalize on the opportunities presented by the current market environment.