Sector Rotation Strategies: A Comprehensive Guide

Understanding sector rotation strategies is paramount for successful stock market investing. In the dynamic world of trading, savvy investors often rely on sector rotation as a key strategy to capitalize on changing economic conditions. By strategically moving investments into sectors that are expected to outperform while avoiding underperforming sectors, investors aim to maximize returns and reduce risks. In this article, we will explore the intricacies of sector rotation strategies, including their benefits, challenges, and implementation.

Benefits of Sector Rotation Strategies

1. Diversification: Sector rotation allows investors to diversify their portfolios across different industry sectors, reducing the impact of sector-specific risks on their overall returns. By investing in a broad range of sectors, investors can achieve a balanced portfolio that is more resilient to market volatility.

2. Performance Potential: Sector rotation strategies aim to capitalize on the relative strength of different sectors at different stages of the economic cycle. By investing in sectors that are expected to outperform in the current economic environment, investors can potentially achieve higher returns compared to a buy-and-hold approach.

3. Risk Management: Sector rotation strategies help investors navigate market fluctuations and reduce risks associated with individual stock holdings. By rotating investments into defensive sectors during downturns and cyclical sectors during upswings, investors can manage their portfolio risks more effectively.

Challenges of Sector Rotation Strategies

1. Timing the Market: One of the biggest challenges of sector rotation strategies is accurately timing the market cycles. Identifying when to rotate investments into and out of specific sectors requires a deep understanding of economic indicators, market trends, and sector-specific factors. Making the wrong move can result in missed opportunities and potential losses.

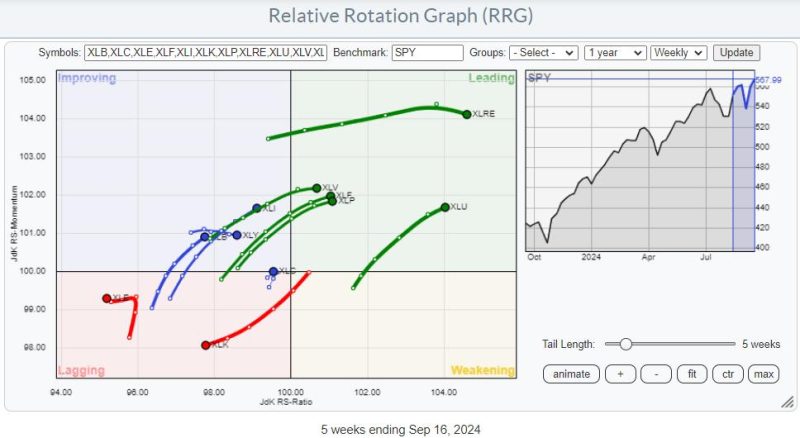

2. Sector Selection: Choosing the right sectors to invest in can be a daunting task for investors. Each sector behaves differently based on various factors such as interest rates, inflation, and geopolitical events. Conducting thorough research and analysis is essential to identify sectors with strong growth potential and relative strength.

3. Overtrading: Implementing sector rotation strategies frequently can lead to excessive trading and transaction costs, which can erode returns over time. To avoid overtrading, investors should have a disciplined approach and focus on long-term trends rather than short-term fluctuations.

Implementation of Sector Rotation Strategies

1. Economic Analysis: Start by analyzing the current economic environment and identifying key trends that are likely to impact different sectors. Understanding how sectors perform in various stages of the economic cycle can help you position your portfolio strategically.

2. Sector Selection: Identify sectors that are expected to benefit from prevailing economic conditions and have strong growth prospects. Consider factors such as earnings growth, valuation, industry trends, and macroeconomic indicators when selecting sectors for rotation.

3. Portfolio Rebalancing: Regularly review your portfolio and reallocate investments across sectors based on your sector rotation strategy. Rebalancing ensures that your portfolio remains aligned with your investment objectives and risk tolerance.

In conclusion, sector rotation strategies are powerful tools that can help investors navigate the complexities of the stock market and optimize their portfolio performance. By diversifying across sectors, capitalizing on performance potential, and managing risks effectively, investors can enhance their investment outcomes and achieve long-term financial success. However, implementing sector rotation strategies requires careful planning, diligent research, and disciplined execution to maximize their benefits and overcome challenges.