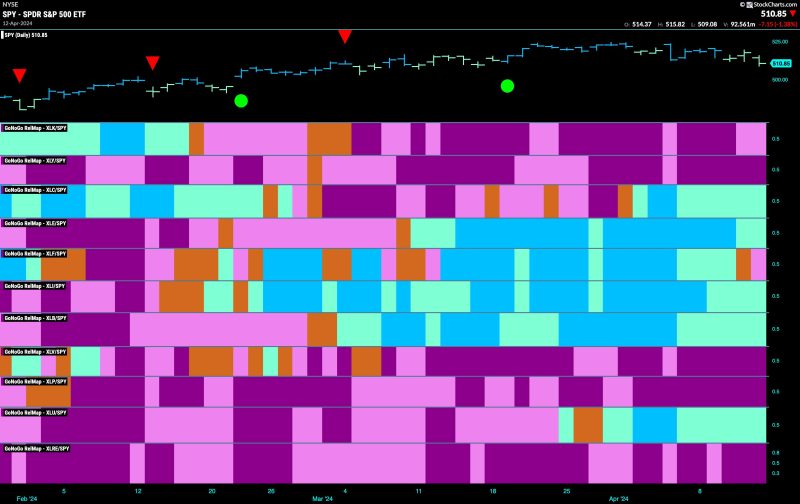

Equity Markets Struggle to Hold Onto Go Trend as Industrials Try to Lead

The equity markets across the globe continue to grapple with uncertainty as they strive to maintain the upward trend that has defined recent months. On April 15, 2024, the world witnessed a mixed bag of performances in the financial markets, with industrial sectors emerging as potential leaders amidst the prevailing challenges. Let’s delve deeper into the trends and factors shaping the current state of the equity markets.

1. Industrial Sectors Take the Lead

One notable development in the equity markets is the growing momentum in the industrial sectors, which are attempting to take the lead and drive the markets towards stability. Despite facing headwinds such as supply chain disruptions and geopolitical tensions, industrial companies are showcasing resilience and a capacity for growth. Investors are closely monitoring the performance of key industrial players for insights into broader market movements.

2. Challenges in Sustaining the Go Trend

The prevailing uncertainty in the equity markets is evident in the struggle to sustain the ‘Go Trend’ that has been a defining feature of recent market behavior. While fluctuations are a natural part of market dynamics, the current environment is characterized by heightened unpredictability, making it challenging for investors to gauge the direction of the markets accurately. As a result, market participants are exercising caution and closely monitoring economic indicators for signs of stability or potential downturns.

3. Global Economic Factors at Play

The performance of equity markets is intricately linked to a myriad of global economic factors that influence investor sentiment and market dynamics. From trade tensions and inflation concerns to interest rate policies and geopolitical developments, the interconnected nature of the global economy means that events in one region can have far-reaching implications for markets worldwide. As investors navigate this complex landscape, they are closely monitoring economic data and policy decisions to anticipate market movements and adjust their strategies accordingly.

4. Strategies for Market Resilience

In the face of ongoing market challenges, investors are exploring various strategies to enhance resilience and navigate turbulent waters. Diversification, risk management, and staying informed about market trends are essential components of a robust investment approach. By maintaining a balanced portfolio, incorporating defensive assets, and staying agile in response to changing market conditions, investors can position themselves to weather volatility and capitalize on emerging opportunities.

5. The Path Ahead

As equity markets continue to grapple with uncertainty, staying abreast of evolving trends and factors shaping market dynamics is crucial for investors seeking to make informed decisions. While challenges persist, opportunities also abound for those willing to adapt to changing conditions and seize openings for growth. By maintaining a long-term perspective, diversifying their portfolios, and staying attuned to market developments, investors can position themselves for success in an ever-evolving financial landscape.

In conclusion, the equity markets’ struggle to hold onto the ‘Go Trend’ reflects the ongoing uncertainties and challenges confronting investors in today’s volatile environment. By closely monitoring industrial sectors, navigating global economic factors, and implementing resilient investment strategies, market participants can enhance their ability to navigate market fluctuations and capitalize on emerging opportunities. Staying informed, agile, and proactive will be key to success in the ever-changing world of finance.