Equities Say, Go Fish! How Healthy Are the Markets?

In a world where economic stability and financial security are crucial, the health of the equities markets plays a vital role. Investors, analysts, and experts constantly monitor the performance of stocks, bonds, and other securities to gauge the overall health and stability of the markets. But what exactly determines the health of the equities markets, and how can we assess their current state?

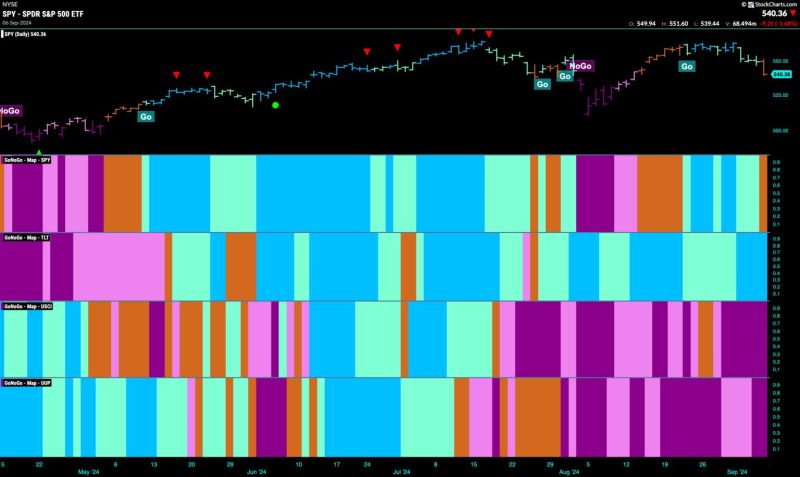

One of the key indicators of market health is the performance of major stock indices, such as the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite. These indices track the performance of a select group of stocks and provide insights into the overall direction of the market. An upward trend in these indices usually indicates a healthy and bullish market, while a downward trend may suggest potential challenges or uncertainties.

Another important factor to consider is market volatility. Volatility refers to the degree of variation in the prices of securities and is often measured using indicators such as the CBOE Volatility Index (VIX). High volatility can indicate uncertainty and risk in the market, while low volatility may signal stability and confidence among investors.

Moreover, market liquidity is a critical aspect of market health. Liquidity refers to the ease with which securities can be bought or sold without significantly impacting their prices. A market with high liquidity provides investors with the flexibility to enter and exit positions quickly, while a lack of liquidity can lead to price distortions and potential market inefficiencies.

Additionally, the overall economic environment plays a significant role in determining the health of the equities markets. Factors such as GDP growth, inflation, interest rates, and unemployment rates can all impact market performance and investor sentiment. A strong economy generally correlates with healthy market conditions, while a weak or recessionary economy may lead to market downturns and bearish trends.

Furthermore, geopolitical events and global market dynamics can influence market health and stability. Issues such as trade disputes, political tensions, natural disasters, and currency fluctuations can all cause market disruptions and affect investor confidence. Keeping a close eye on these external factors is essential for understanding the broader context in which the equities markets operate.

In conclusion, assessing the health of the equities markets requires a comprehensive analysis of various factors, including stock market performance, volatility, liquidity, economic conditions, and external influences. By monitoring these indicators closely and staying informed about market trends and developments, investors can make more informed decisions and navigate the ever-changing landscape of the financial markets with greater confidence and clarity.