The rise of cryptocurrency has undoubtedly revolutionized the financial landscape, offering exciting opportunities for investors and entrepreneurs. However, with great potential comes great risks, as highlighted by the recent case of a cryptocurrency pig butchering scam that wreaked havoc on a Kansas bank and led to the imprisonment of its former CEO.

The intricacies of this elaborate scheme, which entailed the fraudulent sale of nonexistent cryptocurrency assets under the guise of a legitimate investment opportunity, serves as a cautionary tale for both seasoned investors and novices alike. This case underscores the importance of due diligence and skepticism when engaging in any financial transaction involving digital assets.

The scam, orchestrated by a group of sophisticated fraudsters posing as investment advisors, targeted unwitting clients seeking to capitalize on the booming cryptocurrency market. By promising lucrative returns on their investments in a fictional cryptocurrency called PigCoin, the scammers were able to lure in unsuspecting victims, including the CEO of the Kansas bank, who fell victim to their deceptive tactics.

What initially appeared to be a promising investment opportunity quickly unraveled, as investors discovered that they had been duped into a Ponzi scheme with no underlying assets to support the promised returns. The fallout from the scam was catastrophic, causing significant financial losses to investors and shattering the reputation of the bank at the center of the controversy.

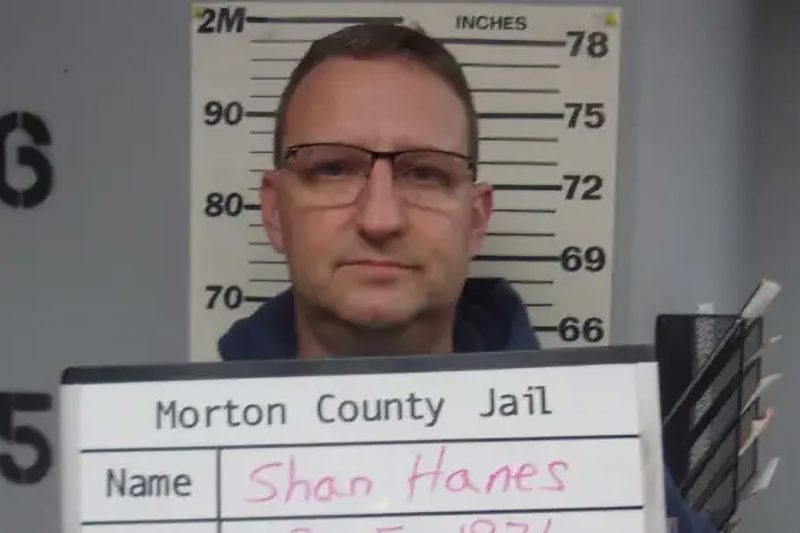

The former CEO, who had unknowingly become complicit in the fraudulent scheme by promoting the nonexistent PigCoin to bank clients, was sentenced to a staggering 24 years in prison for his role in the elaborate scam. The severity of the punishment underscores the legal consequences that await those who engage in fraudulent activities and exploit the trust of others for personal gain.

This case serves as a stark reminder of the importance of conducting thorough research and exercising caution when navigating the complex world of cryptocurrency investments. As the digital asset market continues to evolve and attract new participants, vigilance and skepticism are essential tools for safeguarding oneself against potential scams and fraudulent schemes.

In conclusion, the cryptocurrency pig butchering scam that rocked a Kansas bank and resulted in the imprisonment of its former CEO serves as a cautionary tale for anyone considering investing in digital assets. By learning from the mistakes of others and staying informed about the risks associated with cryptocurrency investments, individuals can protect themselves from falling victim to similar schemes in the future.