Certainly! Here is a well-structured and unique article based on the reference link provided:

—

Amidst the ever-evolving financial landscape, analysts and investors are constantly on the lookout for key indicators that may signal impending market shifts. One such critical element being scrutinized is the state of financials and the signals they may be sending to the larger market. As financials play a crucial role in reflecting the overall health of the economy, any significant warning signals in this sector can have far-reaching implications.

At the forefront of this discussion is the recent uptick in borrowing costs for financial institutions. Rising interest rates can increase borrowing expenses for banks and other financial entities, potentially impacting their profitability and lending practices. The spike in borrowing costs can also weigh on the broader market sentiment, leading investors to reevaluate risk exposure and asset allocation strategies.

Another cause for concern is the mounting levels of debt within the financial sector. As leverage increases, so does the vulnerability of financial institutions to external shocks and economic downturns. Elevated debt levels can constrain the ability of firms to navigate through turbulent times, increasing the likelihood of defaults and systemic risks. Investors closely monitoring these developments are wary of a potential domino effect that could reverberate across the financial system.

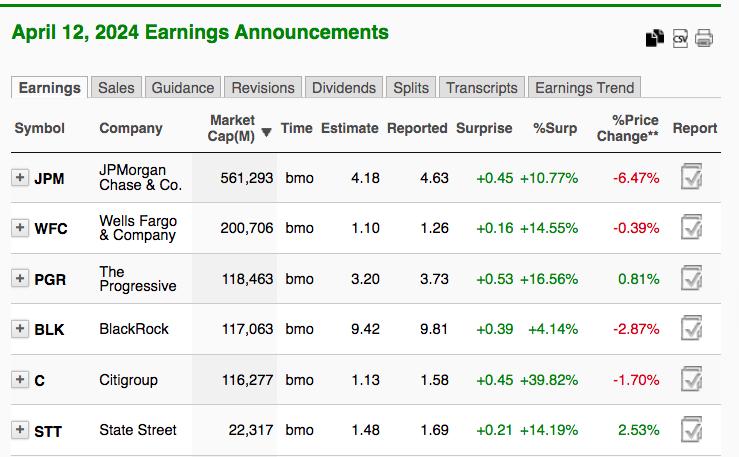

Furthermore, the performance of key financial stocks can provide valuable insights into market sentiment and investor confidence. A sharp decline in the stock prices of major financial institutions may indicate underlying concerns about the sector’s stability and growth prospects. Investors paying attention to these trends may adjust their portfolios or investment strategies in response to the perceived risks emanating from the financial sector.

Additionally, regulatory changes and government policies can significantly impact the financial landscape and shape market dynamics. Shifts in regulatory frameworks or interventions by authorities can influence the behavior of financial institutions and investors, altering market outcomes and risk profiles. As such, a careful analysis of regulatory developments is essential in gauging the potential impact on financial stability and market performance.

In conclusion, the financial sector serves as a barometer for broader market trends and economic health. By closely monitoring key indicators such as borrowing costs, debt levels, stock performance, and regulatory changes, analysts and investors can gain valuable insights into potential warning signals that may impact market dynamics. As uncertainties persist in the financial landscape, a proactive approach to risk management and strategic decision-making becomes imperative for navigating the complex interplay of financial forces in today’s markets.

—

I hope you find this article informative and engaging. Let me know if you need any further modifications or assistance.