Sector Rotation Models: A New Approach to Investment Strategy

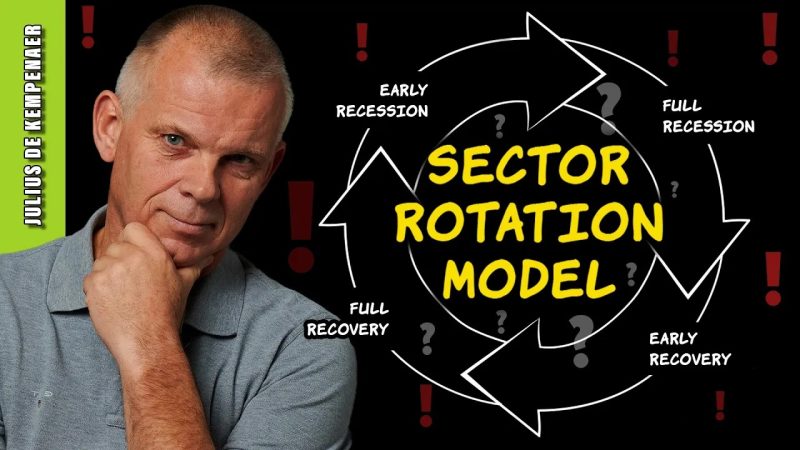

The concept of sector rotation is not a new phenomenon in the world of investing. It has been used for decades by investors seeking to capitalize on shifting market trends and economic conditions. Sector rotation involves strategically reallocating investments among different sectors of the economy based on macroeconomic data and industry trends.

However, traditional sector rotation models often rely on simplistic metrics and fail to capture the complexity of today’s dynamic markets. In response to this challenge, a new approach to sector rotation has emerged that leverages advanced algorithms and data analysis techniques to identify investment opportunities with higher accuracy and efficiency.

The new sector rotation model integrates a wide range of factors, including economic indicators, market sentiment, and sector-specific data to generate more precise signals for investors. By combining quantitative analysis with qualitative insights, this model can uncover hidden trends and patterns that may not be apparent through traditional methods.

One key advantage of this new approach is its ability to adapt to rapidly changing market conditions. As the investment landscape evolves, the model can quickly adjust its recommendations to reflect the latest trends and opportunities. This dynamic flexibility enables investors to stay ahead of the curve and capitalize on emerging market themes.

In addition, the new sector rotation model incorporates risk management principles to help investors mitigate potential losses during periods of market volatility. By diversifying investments across multiple sectors and asset classes, the model aims to reduce overall portfolio risk and enhance long-term returns.

Despite its promising features, the new sector rotation model is not without its limitations. The reliance on data and algorithms may overlook certain qualitative factors that can influence market behavior, such as political events or regulatory changes. As a result, investors should exercise caution and use the model as one of several tools in their investment decision-making process.

In conclusion, the development of a new sector rotation model represents a significant step forward in the world of investing. By leveraging advanced technology and data analysis techniques, this model offers a more sophisticated and nuanced approach to sector rotation that can help investors navigate today’s complex and fast-paced markets. While not a panacea for all investment challenges, the new model has the potential to enhance investors’ ability to generate alpha and manage risk in an ever-changing financial landscape.