In recent days, the financial world has been abuzz with discussions surrounding the Hindenburg Omen flashing an initial sell signal. This development has sparked concerns among investors and traders as they grapple with the potential implications for the markets. The Hindenburg Omen, named after the infamous Hindenburg airship disaster, is a technical indicator that is thought to signal a heightened probability of a stock market crash.

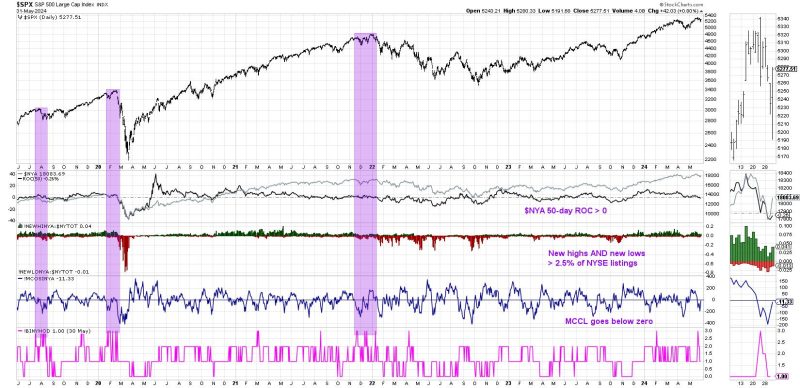

Typically, the Hindenburg Omen is identified when a series of criteria are met simultaneously. These criteria include a rising 52-week moving average, a high number of stocks hitting 52-week highs and lows, as well as market breadth divergences. When these conditions are met, the Omen is triggered, indicating a potential market downturn.

The flashing of an initial sell signal by the Hindenburg Omen has led to mixed reactions from market participants. Some view it as a significant warning sign that should not be ignored, while others argue that the indicator may not always accurately predict market crashes. It is essential to note that technical indicators like the Hindenburg Omen are just one tool in a trader’s toolbox and should not be used in isolation to make investment decisions.

Market sentiment plays a crucial role in determining the impact of signals such as the Hindenburg Omen. Fear and uncertainty can quickly lead to panic selling, exacerbating market movements. Conversely, rational analysis and a long-term perspective can help investors navigate turbulent times and make informed decisions.

As investors digest the implications of the Hindenburg Omen’s initial sell signal, it is essential to keep in mind the broader market context. Economic fundamentals, geopolitical developments, and central bank policies all play a role in shaping market trends. While technical indicators can provide valuable insights, they should be viewed as part of a comprehensive analysis framework.

In conclusion, the flashing of an initial sell signal by the Hindenburg Omen has brought renewed attention to the potential risks facing the markets. Investors are advised to stay informed, exercise caution, and seek professional guidance when navigating uncertain market conditions. By maintaining a diversified portfolio, managing risk effectively, and staying disciplined in their investment approach, investors can weather market volatility and position themselves for long-term success.